With uncertainty around the current political and economic climate, our clients across the South East have been telling us that they have found it so difficult to predict the future that it has led many to postpone investment plans, delay acquisitions and take a more conservative approach to their ambitions for growth.

Now that we are coming to the “end of the beginning” of the Brexit process, we believe that this relative pause in activity is coming to a close. The economic clarity from this will provide an increased ability for businesses to predict the future giving sufficient certainty for investments to be made.

There will be uncertainty remaining for several years as the detailed rules are implemented but we would not expect those matters of detail to stop businesses moving forward.

In order to help our clients move forward with confidence, I was delighted to welcome my colleagues Joe Brusuelas, RSM US chief economist, Simon Hart, RSM UK Brexit lead partner, and Brad Ashton, RSM UK international trade partner to a special conference in Gatwick to explore some of the challenges and opportunities ahead.

RSM chief economist Joe Brusuelas highlighted the top four risks to the global economy:

“US/China – this could escalate into a full trade war if both sides enter a beggar-thy-neighbour dispute.

“Italy – the Government’s attempts to release itself from the EU-imposed fiscal straitjacket could have implications for the future of the single currency.

“Emerging markets – countries with large dollar-denominated debts may struggle if the dollar strengthens or US interest rates rise.

“Brexit – a disorderly exit from the EU could affect the financial markets and have an adverse impact on the real UK economy.”

Economic impact of different types of Brexit

Simon Hart opened his address by expressing confidence that a deal with the EU would be done, but warned delegates that they should only expect this at the ‘11th hour and 59th minute’. However, he was more cautious about the government’s ability to clear the domestic political hurdles.

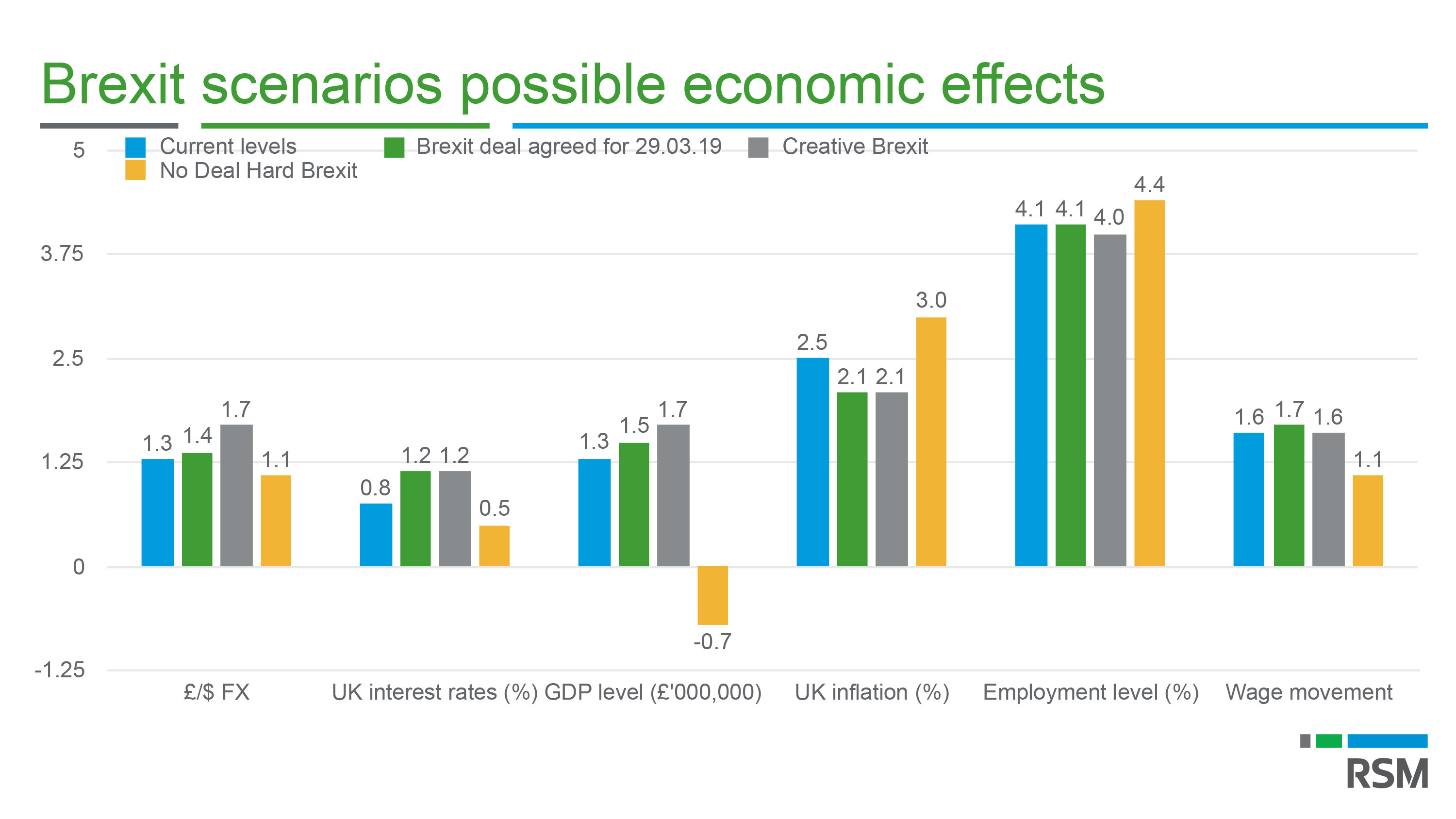

RSM unveiled its proprietary research looking at the economic impact of three possible Brexit outcomes.

Joe Brusuelas explained: “If there is a deal agreed by the end of March next year, we’re going to see appreciation of the pound, which will increase purchasing power and help reduce the deadweight caused by inflation. Growth will pick up mildly and we’d be likely to see rates rise to 1.2 per cent, while wages and unemployment would remain fairly sticky.”

He noted that a ‘creative’ Brexit, whereby the parties ‘kick the can down the road until 2021’ and beyond, and in effect we stay aligned to the EU for a longer period, was an outcome that would most improve the economic outlook for the UK, and one which could lead to an increased pace of growth, improved living standards and a recovery of sterling against the dollar to the pre Brexit vote levels.

“Of bigger concern would be a no deal outcome”, he added. “This would result in a 20 per cent depreciation of sterling within 12 months, which would take inflation up to a cyclical high. Interest rates would drop and growth would slow to almost zero.”

Preparing for Brexit

With so many scenarios in play, RSM is advising middle market leaders to take the opportunity to carry out a top-down review of five key areas of their business.

• Regulation and compliance

• Financial planning and management

• Trade;

• People and talent management

• Business management.

Simon Hart explained, “One of the most important priorities for businesses should be scenario planning and financial modelling including sensitivity for labour and supply chain costs, as well as delivery delays.”

On the UK’s productivity challenge, he urged businesses to consider enhanced automation and artificial intelligence and invest in enterprise resource planning systems instead of relying on spreadsheets.

Finally, he said, “Keeping hold of your key talent will be vital. Put your arms around the EU workers you need – make sure you are communicating with them and letting them know that they are appreciated.”

Preparing for the new customs regime

RSM’s international trade partner Brad Ashton warned: “Businesses that trade with the European Union face a perfect storm. In addition to the unknown outcome of Brexit, business will have to cope with a new Customs Declaration Service, adopt new processes for import VAT and get to grips with the introduction of the new Making Tax Digital system for VAT. This will result in a significant amount of work that will be a challenge for any business to manage.”

Post-Brexit, the number of customs declarations is expected to increase from around 55 million currently to around 255 million each year. Depending on the outcome of negotiations, an additional 145,000 companies who trade solely with the EU might be required to make customs declarations for the first time.

Businesses will also have to manage the introduction of ‘postponed accounting’ – a measure designed to mitigate the impact of import VAT on UK importers in a ‘No Deal’ Brexit.

Top tips from RSM’s Gatwick team

Laurent Doggett, VAT Specialist.

Review supplier/customer contracts and whether they might need to be amended as a result of leaving the EU. Many contracts may currently be silent on matters, such as Incoterms.

To reduce interruption, goods suppliers should look at their EU supply chains and delivery models. Service providers should consider how their non-EU status may impact operations.

Kirsty Sandwell, Corporate Finance Specialist

For those looking to grow through acquisition, now is the right time to prioritise your targets and do your homework. With many having built up cash war chests, the ability to execute quickly may be the difference between being successful and being the underbidder.

If you have been looking to sell your business, now is the time to prepare and make your business ready to be scrutinised. A fresh pair of eyes will help you see your business like an acquirer and act accordingly to help maximise the price.

David Williams-Richardson, Employment Solutions Specialist

Retaining employees will be key post Brexit. Ensure that you have assessed the reliance on EEA nationals working in the UK or UK nationals assigned to work in Europe.

Keep up to date on developments and communicate with the workforce on the potential impact and provide appropriate support where required.

Consider the impact of currency fluctuations on the pay for any expatriate employees and ensure that you apply a consistent approach that is recorded in the assignment letter.

Andrew Lister, Corporate Tax Specialist

Understand where you currently benefit from a reduction in tax because of EU tax law eg some dividends from EU subsidiaries.

Changes in how a business operates may change the impact of transfer pricing.

Don’t forget domestic law and double tax treaty changes after BEPS.

-

RSM Gatwick Office Portland,

25 High Street, Crawley,

West Sussex, RH10 1BG

T: 0845 057 0700