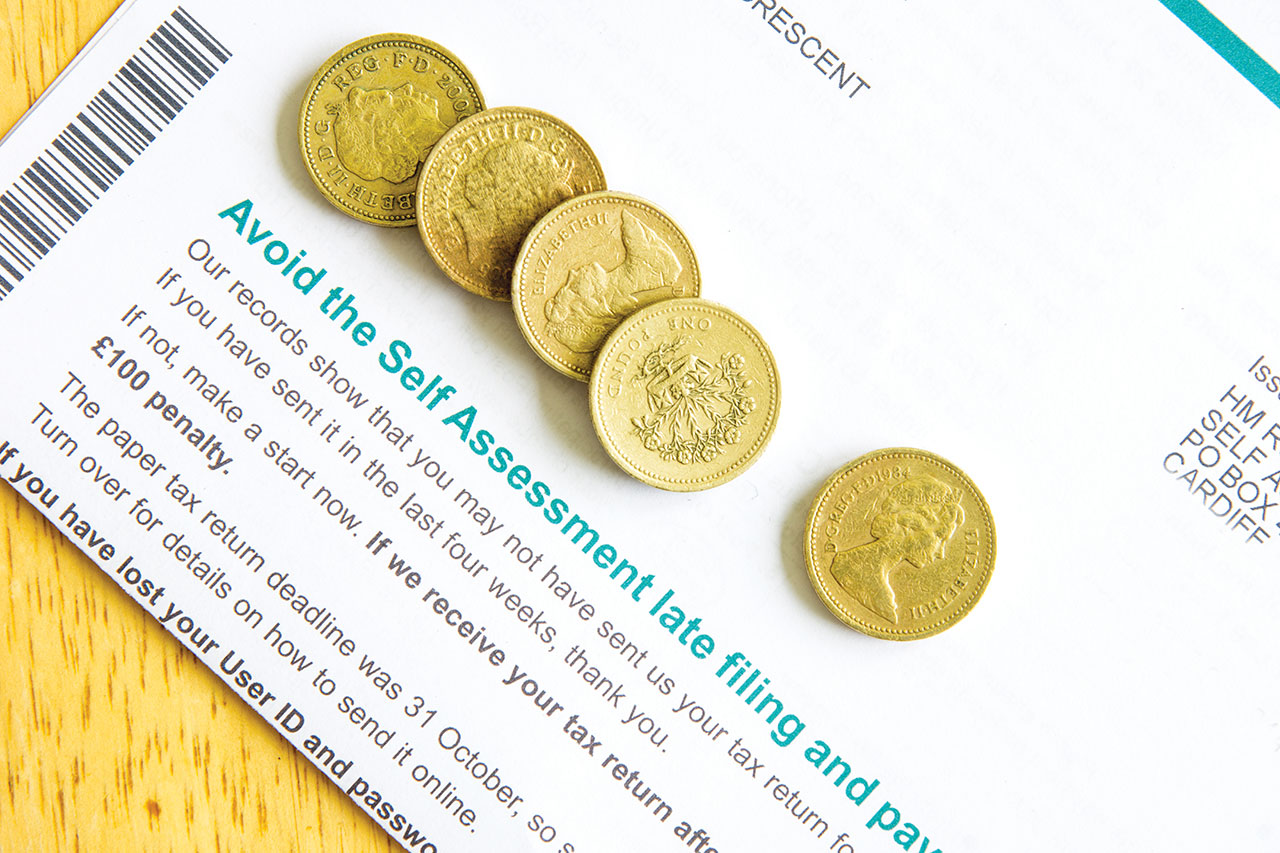

It’s easy to get caught up in the festive period, but we should spare a thought about finances, in particular making sure your tax return is submitted on time.

The world will not end if you do not file your tax return on time; however, the fines quickly mount up if you do. If it’s late, you will incur a £100 filing penalty. You then have three months from 31st January to submit your tax return before your fine will increase by as much as £10 per day thereafter. You will also incur interest on the tax you owe from 31st January. If you are a repeat offender and have a history of filing late, you risk making yourself vulnerable to an HMRC enquiry.

People often think they don’t need to file a return because they didn’t trade or didn’t make any money in the tax year. There are various reasons why you would need to file a tax return including where you are self- employed or rent property, among other reasons. If HMRC has requested that you file a return, then you must submit one. You can check whether HMRC are expecting a tax return from you based on your status at the HMRC website: www.gov.uk/self-assessment- tax-returns/who-must-send-a-tax-return

Your tax adviser is the lifeline you need when it comes to submitting your return. They can often help you to uncover hidden opportunities for tax relief such as pension contributions or Gift Aid payments.

For example, did you know that subscriptions to specified professional bodies are tax deductible? Have you considered any business mileage that has not been reimbursed by your employer? When it comes to self-employment, understanding which expenses are tax deductible is key. These are all things that your tax adviser can assist you with.

In December 2016, HMRC revealed some of the worst excuses for late tax returns including: “My tax return was on my yacht, which caught fire” and “Someone borrowed it and lost it”.

Of course, there are some genuine occasions that HMRC will accept as a reasonable excuseSuch matters could include a technological issue on HMRC’s part, for example if their site was down, where you have been subjected to oods and your records have been destroyed prior to the deadline, or a death or serious illness. The best solution is of course to file your tax return in good time.

If you need help with any aspect of your tax return please contact the tax team at Wilkins Kennedy’s Guildford and Egham offices for more information.

e: steve.hoare@wilkinskennedy.com Guildford office – 01483 306 318 Heathrow office – 01784 435 561