As I write, disputes over the Chequers deal are not just continuing but escalating. As a result, businesses and professionals alike have a great deal of uncertainty about cross-border VAT. Although HMRC have released documentation indicating how a no-deal Brexit would impact on VAT rules for UK businesses, there are as yet no practical steps saying for example how to plan your IT. This is understandable. As with all other member states – HMRC are aiming to make tax digital (MTD) as soon as possible but at this stage are still in the consultation period.

For businesses based, and buying and selling, in the UK, post Brexit changes are likely to be minimal. Even if no deal is reached, HMRC will aim to keep VAT procedures as close to how they look now – except in so far as they are now moving strongly to MTD. However, for those that buy or sell in the EU there will be some changes regardless of whether it’s a hard or soft Brexit, as the UK will be out of the EU and hence out of the EU VAT regime.

For example, it will mean that businesses selling digital services will instead have to use the non-EU MOSS scheme. Also distance selling thresholds will no longer apply to businesses selling goods to private customers in the EU and this may mean they will need to register for VAT in other EU countries. They will then be legally required to prepare VAT returns in those countries.

UK businesses will still be able to claim VAT refunds from EU member states on hotel bills, taxis, exhibition or events but will need to use instead the paper process that currently exists for non-EU businesses – they will not be able to use the EU VAT refund system through their UK tax portal. These will have to be submitted in the precise form required for each member state. So are you ready to submit a claim in German or Greek?

Most readers will know that the Government is moving strongly towards digitisation. Their prime aim is to reduce tax avoidance and evasion. However, it is also good for businesses (less paper, less error, easier to report and have dialogue). I read a recent report stating that over 50% of businesses in the UK are not prepared at all for MTD. This is exacerbated if they have many subsidiaries, and more than one accounting system. The preparation of many returns, each with different rules, is a challenge especially when you throw in currency and language problems. For information, the UK’s MTD approach is minimal compared with other countries – eg Spain – where individual transactions are being recorded in real time! So watch out.

I’m pleased to see that a number of our competitors are now busy with MTD preparations, and some taking part in the HMRC VAT digitisation pilot in order to be ready for auto preparation of UK VAT returns by April. One or two are aiming to copy our lead of a simplified online process for foreign VAT returns and for claiming refunds.

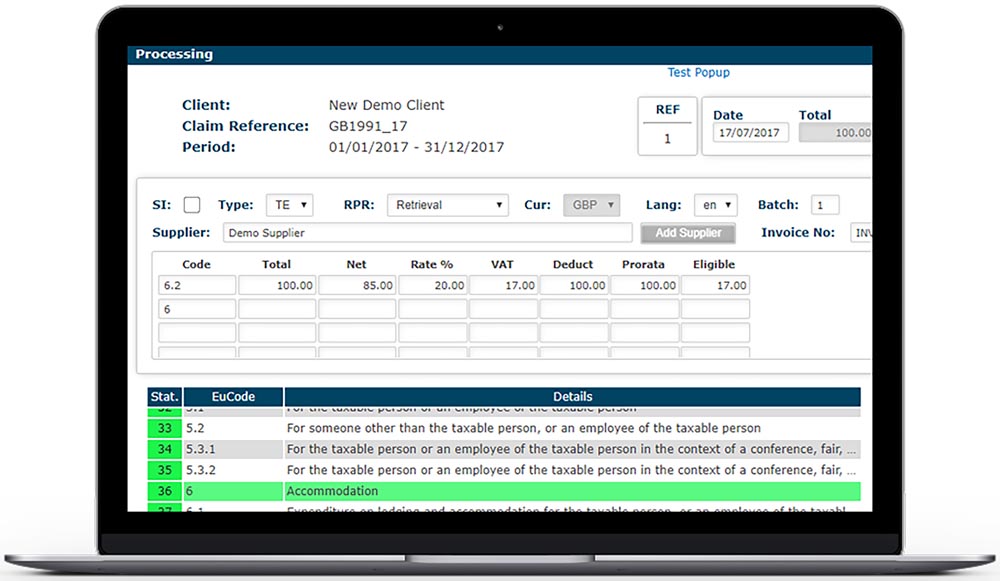

Indeed, we have been for over a year! And for that matter, not just in the UK. We already provide an online service to enable any size business regardless of their location worldwide, to prepare VAT returns in all but one member state (this because the tax authority recently changed procedures!). We already provide an online tool for VAT professionals to facilitate cross border VAT reclaims. It incorporates tools like automatic VAT coding to help to make life easy (see image below).

Both the returns and refund products can be used by any organisation even if they have multiple subsidiaries with multi currencies. In the background, we constantly monitor changes in VAT legislation across Europe and build these in as they occur. Just as well because in the EU, on average there is approximately one change in VAT rules every day!

Whatever happens with Brexit and/or MTD our clients are covered. I’m extremely proud of my team that have kept us ahead of the game. Our motto: “We take care of technology. Our clients take control.”

Martyn Redman

euVAT Online.

01273.325000