For the vast majority of UK residents, the pension represents one of the

most valuable assets we will own in our lifetimes.

Realising long term lifestyle aspirations

Workers in Britain today will likely spend between 20% and 33% of our lives retired and if we want a fighting chance of realising our retirement lifestyle aspirations, we must perform essential maintenance and look for chances to improve our pension solutions sooner rather than later. The results may be less tangible in the short term, but they are life changing in the long term.

The pension-saving journey is like the voyage of a vast ship on the ocean; you must have a good navigator checking the charts regularly to ensure you don’t run off course. If navigation is neglected it takes a long time to change direction, so your arrival may be delayed (or overly expensive).

Why have a pension review now?

There is no time like the present to get started. Here is an overview of the key reasons why now is a great time for a pension review:

1 Pricing – your scheme may be charging too much

General market evolution, technology and outsourcing has brought downward pricing pressure on the pension sector for 20 years. There are hundreds of billions of pounds marooned in older style schemes charging too much.

2 Features – Your older scheme may not be working for you

Post-2015 Pensions Freedoms rules mean nobody is forced to buy an annuity if they don’t want one. Savers can draw a variable income from an invested pension from age 55. Many older schemes don’t offer this but charge more than the modern schemes that do.

3 Legacy – new rules allow you to pass on your pension to dependents

New rules allow unused pension savings to be passed to dependents or non-dependents via lump sum, annuity or flexi access drawdown. The latter empowers the cascading of wealth down a theoretically unending number of generations. In the majority of cases, Inheritance Tax is not applied to pensions.

4 Investments – more low-cost solutions are available

The proliferation of choice has led to downward price pressure on investment options. Increased transparency and analytical tools allow advisers to identify higher quality and better value solutions for their clients. The adoption into the mainstream of indexing strategies has opened up new low-cost solutions that are popular with some.

5 Socially Responsible Investing – there are great options for ethical investing

No longer must you pay over the odds or experience poor performance for selecting ethical investment solutions. These solutions have achieved cost parity and now offer comparable, or sometimes even greater, returns.

6 Consolidation – savers can lose track of all their pensions

With career mobility on the rise in the modern economy, gone is the job for life. Couple this with the adoption of Auto Enrolment and employees are accumulating a large collection of pensions. Savers view it as hard work keeping track of them all.

7 Shortfall analysis – will you have enough in retirement?

A pension review can act as a health check to reveal your current pension funding trajectory. We can reveal if you are falling short, how much extra you need to save, or indeed what age you may be able to afford to retire, using sophisticated forecasting software. How much of your race is left to run, where is that finish line?

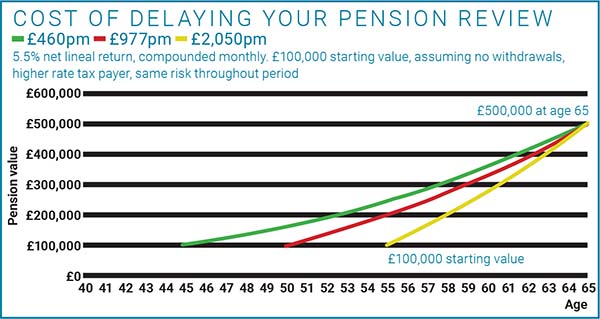

The cost of delaying your pension review

The graph below illustrates the power of compounded returns and relative value of time/early action when it comes to pension savings. It compares three savers who reach three different ages and find themselves with a £100,000 pension value, when they identified they need a £500,000 pension value at age 65.

This chart quantifies how powerful earlier action can be with pensions. How much of the total can the market give you compared with funding yourself?

The saver who took action at 45 will enjoy considerably more spare money than their counterparts, as the compounding returns over time have rewarded their foresight and patience richly.

Get in touch

For more information on saving for retirement, get in touch with our friendly team of Independent Financial Advisers by contacting Roy on 01903 534587

or visit our website: www.carpenterboxfa.com