Making Tax Digital (MTD) for Business is a key part of the Government’s plans to make it easier for businesses to get their tax right and keep on top of their tax affairs. Keeping digital records and providing updates to HM Revenue & Customs (HMRC) directly should in theory help reduce errors, cost, uncertainty and worry.

Who does it affect?

The first deadline is rapidly approaching: from April 1st 2019, all VAT registered businesses with turnover above the VAT threshold (currently £85,000) will be required to:

- Maintain digital records (for VAT purposes only)

- Provide their VAT information to HMRC using third party commercial software

- This includes:

- Unincorporated businesses

- Trusts

- Companies

- Non-UK businesses with a UK VAT registration

- Landlords (e.g. with Options to Tax)

- Charities/trading subsidiaries

VAT registered businesses below the threshold can file their VAT information through MTD if they wish, although they are not required to do this. Initially, there will be no change to the filing or payment deadlines, or to the basic information submitted to HMRC.

From 1st April 2021 all other businesses will be required to comply with MTD.

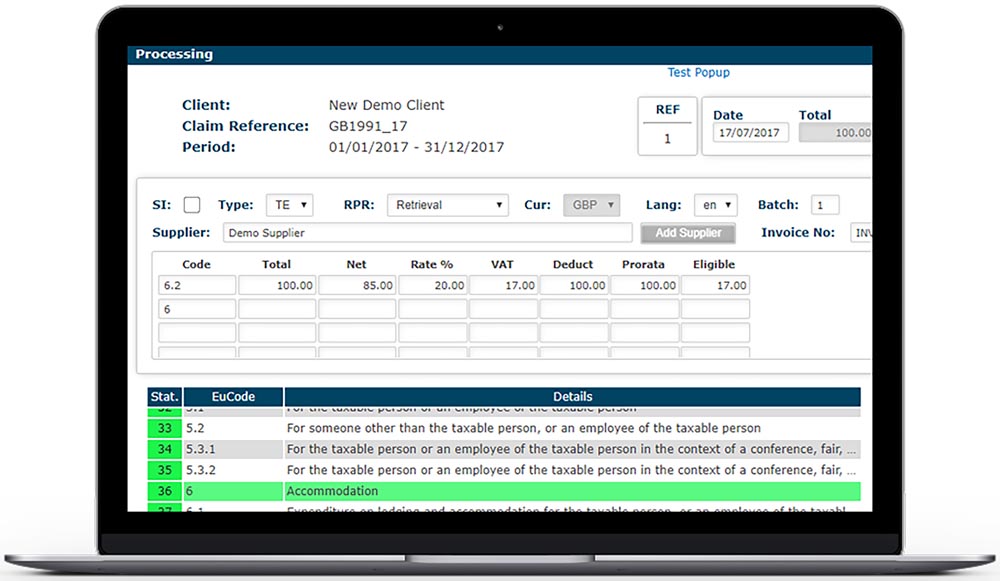

What software can I use?

The biggest challenge in the move to a digital system will be the availability of suitable software. The regulations will require any business within the scope for MTD to use ‘functional compatible software’ to meet the new requirements. HMRC have stated they will not provide free software, however, they are working closely with software providers to ensure a wide range of options will be available.

The software you use must be able to:

- Keep required records in a digital format

- Preserve those records in digital form for up to six years

- Create a VAT return from the digital records

- Provide HMRC with this data on a voluntary basis

- Receive information from HMRC about the business’ compliance record via the Application Programme Interface (API) platform

Do I need to keep digital records?

There will be no requirement for you to keep supporting documents, such as invoices and receipts, in a digital format. However, businesses will need to store transactional information digitally, including the time and value of each supply, together with the applicable VAT rate. Retailers within the VAT retail schemes will be able to keep a record based on their daily gross takings rather than recording details of individual transactions.

Businesses will still be able to use the flat rate scheme under MTD, meaning digital records of purchase invoices will not be required (unless they relate to capital items which cost more than £2,000 including VAT).

What do I need to do to prepare?

Firstly, make sure you understand when MTD affects your business – we strongly recommend you don’t leave this until the last possible moment!

Larger businesses with their own internal IT teams should be liaising with the head of the Finance and Tax Departments to ensure that they are aware of the coming changes and that systems are being developed to cope with these changes.

Smaller businesses’ main priority should be implementing a cloud accounting system if they do not currently have one in place. Be sure to contact your accountants to establish what offering they have and whether their accounting software packages will meet the requirements of ‘functional compatible software’.

What are the benefits of MTD?

One of the biggest benefits will be access to real-time information: if your bookkeeping is up-to-date then you will be able to see real-time figures for your business’ performance. If you can see how the business is performing, you are better able to make informed decisions which can improve the profitability of the business.

You will also have far less paperwork, as your software will make automatic records of the money coming and going from your business. You just need to check and update the data with HMRC every quarter.

Finally, you’ll be able to improve your cash flow planning. By getting your annual accounts produced sooner, you will know your tax liability well in advance (and even have time to make strategic decisions to lower your bill), helping you to better plan your cash flow.

How we can help

At MHA Carpenter Box, we offer a wide range of services and support to help you become MTD compliant. We can help you find a cloud solution, submit quarterly submissions to HMRC or even provide training for your team.

While MTD can seem daunting, by updating your accounts more frequently, you’ll have a better understanding of your business position and be able to react to opportunities and threats more quickly.

For more information on Making Tax Digital, please contact Stuart Noakes on 01903 234094. You can also visit www.carpenterbox.com/making-tax-digital for all the latest MTD updates.